ہمارے بہترین اسپریڈز اور شرائط

مزید جانیں

مزید جانیں

The Swedish krona is losing further momentum on Wednesday and is lifting EUR/SEK to fresh multi-day highs near 10.60, where some resistance has turned up.

The krona debilitated further on Wednesday after inflation figures in the Scandinavian economy came in well below expectations during last month.

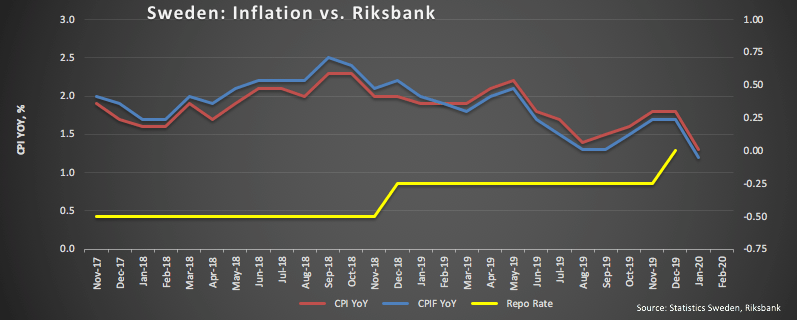

Indeed, headline CPI showed consumer prices rose at an annualized 1.3% in January, markedly lower than December’s 1.8% gain. In addition, CPIF (CPI at constant interest rates) rose 1.2%, down from 1.7% in the previous month, all on the back of lower electricity prices.

Moving forward, current lower-than-expected inflation figures are unlikely to affect the Riksbank’s ‘wait-and-see’ stance, in particularly in light of key wage negotiations in the country due to start in the spring.

The krona has regained upside traction in February following the persistent depreciation seen since mid-December, particularly following the interest rate hike by the Riksbank. In spite of healthy (resilient?) fundamentals, the small and open Nordic economy remains threatened by trade frictions between the US and China (in light of the upcoming ‘Phase 2’ negotiations and via its impact on Germany, Sweden’s key trade partner). Therefore, SEK is predicted to face quite a volatile year, although a rate cut by the Riksbank would need a severe deterioration of the economic outlook, something that looks quite unlikely at the moment and specially after the central bank revised up its forecasts for GDP for the 2020/23 period.

As of writing the cross is gaining 0.29% at 10.5823 and a break above 10.6105 (100-day SMA) would expose 10.6325 (200-day SMA) and then 10.6915 (2020 high Feb.3). On the other hand, the next down barrier emerges at 10.5225 (55-day SMA) followed by 10.4741 (monthly low Feb.12) and finally 10.4497 (2020 low Jan.3).